In a response to a recent speech by FTC Chair Lina Khan concerning merger enforcement, Sean Heather, a Senior Vice President of the Chamber of Commerce argued that “Chair Khan’s FTC would seriously damage the economy’s dynamism.” This statement exemplifies the constant refrain among conservative critics of greater antitrust enforcement that such efforts will result in a weaker macroeconomy.

In April, FTC Commissioner Christine Wilson delivered a talk claiming that the FTC’s endeavor to enforce antitrust law reflects an embrace of Marxism and Critical Legal Studies. Wilson’s screed was rife with errors and misunderstandings about the history of economic thought and philosophy. She concluded that “In Short, perspectives that draw on Marxism and CLS [i.e. those that reject the Chicago School of antitrust] if embodied in antitrust law and policy, will undermine both the incentive and the ability to innovate and will erode the dynamism of the U.S. economy.”

In latest Antitrust magazine, the same argument in support for lax enforcement appears again. This time, Jonathan Jacobson, defending the Consumer Welfare Standard, writes “It [the consumer welfare standard] has held up well for those thirty years, and the U.S. economy has flourished as a result.” Joshua Wright and Douglas Ginsburg proffered the same evidence-free claim in their 2013 Fordham Law Review article: “Indeed there is now widespread agreement that this evolution toward welfare [the consumer welfare standard] and away from noneconomic considerations has benefited consumers and the economy more broadly.”

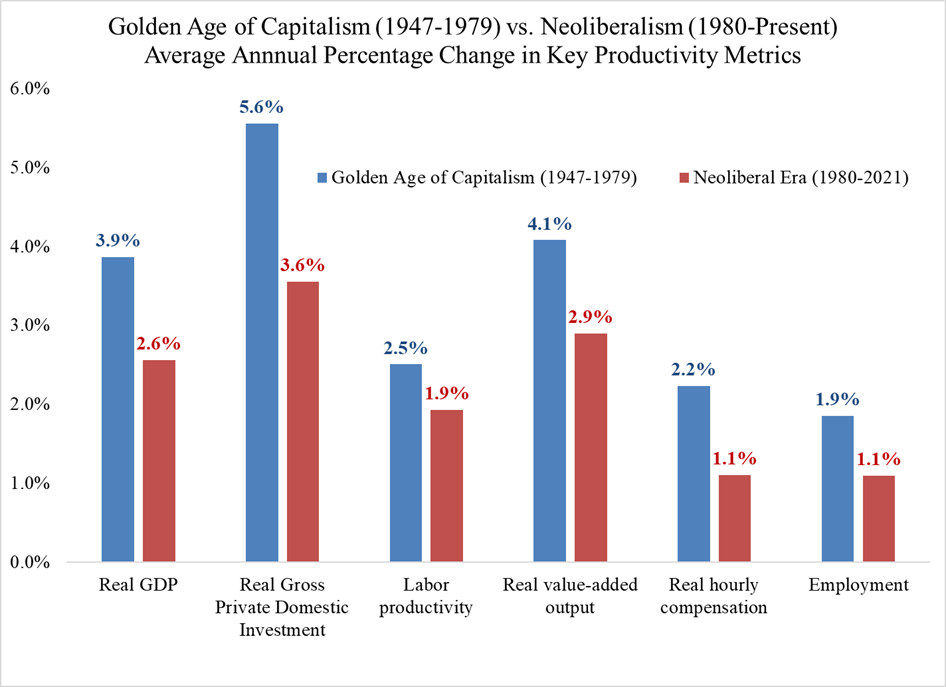

The specious claim that freeing large corporations from the shackles of regulation will benefit the economy by achieving higher levels of growth and performance has no substantive evidentiary basis. Upon hearing such Panglossian claims repeated ad nauseam, one might be tempted to believe that greater economic growth and universal prosperity has accompanied the Neoliberal revolution. But this is not the case.

Indeed, the neoliberal revolution that occurred around 1980–with the election of Ronald Reagan and the appointment of James Miller III (pictured above) as chair of the FTC–reasserted the dominance of large companies, undermined regulation and antitrust, and destroyed America’s union movement, also harmed the economy. In comparison with the period from 1948 to 1980, the period beginning with the rise of neoliberalism after 1980 saw a reduction in growth, lower rates of productivity, lower investment rates, lower growth rates in wages, and greater inequality.

Studies specifically link the inferior post-1980 economic performance reflected in the chart above to the reduction in antitrust enforcement. Gutierrez and Philippon directly tie the drop in corporate investment to rising concentration: “We argue that increasing concentration and decreasing competition in many industries explains an important share of the decline in investment.”

Other papers have examined the relationship between antitrust enforcement and productivity growth. Filippo Lancieri, Eric Posner and Luigi Zingales, citing the seminal work of Robert Gordon, state that “there is no evidence that productivity growth increased as a result of the relaxation of antitrust.” Paulo Buccirossi and his coauthors studied the impact of antitrust enforcement (and other factors) on total factor productivity growth in 12 OECD countries. The authors found the oppositive of the conservative claim: “Our results imply that good competition policy has a strong impact on TFP growth.” In 2014 the OECD published its “Factsheet on how Competition Policy Affects Macro-Economic Outcomes.” Again, the basic finding is that “industries where there is greater competition experience faster productivity growth.”

We find no evidence that the reduction in antitrust enforcement that accompanied the ascension of the consumer welfare standard in the 1980s as the lodestar of antitrust enforcement had any positive impact on growth, productivity or investment. The quest for economic growth ostensibly motivates free market ideology; yet this ideology maintains the myth that it serves the social welfare. Economic evidence says otherwise: the neoliberal revolution destabilized the macro economy and has led to inferior macroeconomic performance. FTC Chair Lina Khan and the New Brandeis School continue to advance policies that will benefit growth and innovation, even if it does not help billionaires accumulate even more obscene levels of wealth.