Just a few weeks shy of its one-year anniversary of the Federal Trade Commission’s landmark monopolization case against Amazon, the government and the world’s largest e-commerce marketplace await a crucial decision: Whether Judge John Chun will dismiss the case before it ever reaches trial.

Amazon’s motion to dismiss the lawsuit has been sitting in front of Judge Chun since December. Since then, both sides have swapped legal paperwork arguing whether the FTC’s case, accusing Amazon of using its stranglehold over online retail to rip off shoppers and third party sellers, is fit to survive until its October 2026 trial date.

Now, two recent court decisions may have made the choice clearer for Judge Chun. Those decisions—one by a D.C. appeals court and another by Fourth Circuit Court of Appeals—appear to strengthen the FTC’s claims that its lawsuit accurately details Amazon’s dominance, and that its description of Amazon’s alleged monopoly abuses are more than enough to survive Amazon’s dismissal request.

To wit: The FTC sued Amazon last September, accusing the company of using a whole suite of tactics to keep rival online marketplaces from attracting shoppers and third-party sellers to their platforms. The 172-page complaint details, among other things, how Amazon strong-arms small sellers into paying outlandish fees in order to succeed on its monopoly e-commerce platform—fees that then force those sellers to raise the price of their products. Amazon then imposes a “fair pricing policy” to punish sellers who seek to steer shoppers to a competing marketplace by charging a lower price for the same products on the rival store, the lawsuit claims. It’s a complex complaint, but it spells out what the FTC calls a “course of conduct” plot—a series of actions that, taken together, shuts out competition and unfairly protects Amazon’s monopoly.

Amazon’s motion to dismiss attempts to cast Amazon as both a champion of consumers and just another retailer that has to compete with everyone from Walmart to the local brick-and-mortar shops down the street. Amazon says that, even if what the FTC says is true, the company’s actions are actually procompetitive; it’s not forcing small sellers to raise their prices across the web, it says, it’s just ensuring Amazon has the lowest price, which helps shoppers.

Amazon’s arguments set up Judge Chun’s decision: Is Amazon an online retail monopolist whose actions suffocate rival online stores and hike up prices everywhere? Or does Amazon compete against everyone and anyone who sells stuff to people, and is doing all it can to keep prices on its marketplace low for shoppers?

The two recent court rulings may help answer those questions. The first ruling, from the D.C. appeals court, overturned a lower court decision to dismiss the District’s monopoly lawsuit against Amazon that mirrors some of the key allegations in the FTC’s complaint.

The D.C. appeals court’s decision is clarifying. The District’s definition of the industry Amazon operates in—namely, “the U.S. retail e-commerce market”—is plausibly the right one, rather than the much larger universe of all retail, brick-and-mortar included, that Amazon claimed to operate in, the court found. That tracks with how other federal courts have defined Amazon’s market, and, the D.C. appeals court says, the lawsuit “offers a plausible basis for its contention that Amazon possesses market power in online product submarkets and in the broader online marketplace.”

The appeals court also pushed aside Amazon’s claim that the abuses the District accused Amazon of— forcing Amazon sellers to raise their prices in order to afford its fees, then restricting sellers from offering lower prices elsewhere—were actually pro-consumer and intended to keep prices low. The appeals court said the District’s description of the real-world effects of Amazon’s fair pricing policy—raising prices for consumers across the web—were enough to overcome Amazon’s motion to dismiss the case. That case will now go back to the local D.C. trial court, and the FTC flagged the decision for Judge Chun.

Meanwhile, the Fourth Circuit court of appeals took up a different issue: Whether “course-of-conduct” monopoly claims could survive a motion to dismiss, even if each individual action that makes up a course-of-conduct claim wouldn’t violate the law alone.

In the FTC’s lawsuit, the agency says each Amazon action that makes up the alleged “course of conduct” is illegal independently. Still, it’s the course-of-conduct allegations that are the central theme of the government’s lawsuit. Amazon’s bad actions are, as the FTC says, “greater than the sum of its parts” in their anticompetitive effect.

While course-of-conduct monopoly claims were already accepted under the law, the Fourth Circuit’s decision makes it abundantly clear that a monopolist’s conduct can break the law when viewed together and holistically, even if a monopolist’s individual actions aren’t obviously anticompetitive on their own.

In that case, upstart energy company NTE sued incumbent utility monopoly Duke Energy, claiming that a series of actions Duke took to maintain its electricity contract with Fayetteville, North Carolina collectively stopped NTE from competing for the city’s business even though it could sell Fayetteville electricity for far cheaper than what Duke could offer.

We’ll skip the details of that lawsuit here, other than to say NTE alleged, more or less, what the FTC is accusing Amazon of doing: Using an interrelated series of actions that, when viewed together, amounted to a monopolist using its power to ensure rivals can’t get a foothold in the market needed to compete—even when, in the Duke Energy case, the upstart rival is more efficient than the monopoly incumbent.

A district court had dismissed the case, looking at each accusation against Duke alone and in a kind of legal silo, detached from every other allegation. When it did, it found that the individual allegations against Duke failed for the same reasons a lot of monopoly lawsuits fail: Because a mountain of pro-monopoly case law over the past decades means lots of fairly obviously bad behavior escapes prosecution.

In its opinion, the Fourth Circuit Court said viewing each allegation individually was a mistake; not only are course-of-conduct monopoly claims allowed, they are often necessary to understand if and when a monopolist is abusing its power and foreclosing competition. This is far from new; the Supreme Court since at least 1913 showed that an antitrust conspiracy should not “be judged by dismembering it and viewing its separate parts, but only by looking at it as a whole.” The Court extended that legal framework to monopolization in the 1960s, and other circuit courts have upheld that standard as recently as the 2000s.

But common law around monopoly claims has become far more restrictive over the past four decades or so, and at least one circuit court less than a decade ago fully ignored the Supreme Court’s demand that judges take a holistic view of anticompetitive conduct. So a reminder to Judge Chun is helpful, and that’s what the Fourth Circuit delivered. When a plaintiff alleges a complex, exclusionary monopoly scheme, looking at each piece of the anticompetitive puzzle individually and applying a specific test to each “would prove too rigid,” the court ruled.

The FTC flagged the Fourth Circuit’s decision to Judge Chun, and Amazon has lodged its rebuttal. Along with the D.C. appeals court decision, they’re just two more pieces of law for Judge Chun to ponder when considering whether the FTC’s lawsuit should survive. Technically, all the commission has to do is present a set of facts that, if proven true, could plausibly violate the antitrust laws. It’s a relatively low bar, but Judge Chun will ultimately decide the lawsuit’s fate. That decision could come as soon as the end of September.

Ron Knox is a senior researcher and policy advocate at the Institute for Local Self-Reliance. His writing has appeared in The Atlantic, The Washington Post, Wired, The Nation and elsewhere.

Professor Tim Wu, former White House advisor on antitrust, offered remedies following Judge Mehta’s decision in the U.S. Google Search case. He identified both Google’s revenue-sharing agreements that exclude competitors and its access to certain “choke points” as a basis for remedies. A divestment order of Chrome and the Android operating system was proposed, as well as an access remedy to Google’s browser, data and A.I. technologies.

It is hard to see how the transfer of a browser monopoly into others’ hands, however, would facilitate access and use of it. That could repeat the mistake of the AT&T 1984 divestiture order that transferred local access monopolies into separate ownership without creating any competitive constraint or pressure on those local business to innovate and compete. In a follow up article, Julia Angwin pointed out the fundamental problem being the Google search results pages, facing no competitive pressure, are now “a pulsing ad cluttered endless scroll,” which masks relevant results. Google’s ad-fuelled profit maximisation leads it to promote that which is remunerative over that which is more relevant.

Also, there remains a major issue with any access order: Will it be able to withstand future technology changes used by Google to circumvent their aims? A crucial issue in writing an order to a monopoly tech company to provide access to XYZ or supply XYZ interface, and the day after the order being written a technical change (or simply version control) making the order technically outdated and pointless.

Any remedy first needs to stop the infringement, prevent its reoccurrence and restore competition. So, the core problem now is to restore competition to the Google search monopoly. This means finding a competing consumer-facing search product that is ad-funded so that “free at the point of use” search can provide competitive pressure on Google’s own free at the point of use product. A possible optionis canvassed below.

The two-sided nature of the search market means any effective solution needs to create consumer-facing competition with Google Search pages and business-facing competition for Google’s Search Text Advertising offering. A starting point for remedies is then prohibiting the mechanisms used by Google that restricted competition from rivals. This means prohibiting the revenue-sharing and default-setting deals with Apple and other technology and telecoms companies that have acted as a moat to protect Google’s Search “castle.” However, restoring effective competition going forward also means enabling the use of data inputs and alternative access points (such as the browser) so competing search ads face competitive price pressure.

The proposal below is inspired by the BT Openreach settlement (and prior BT Consent decree). BT proposed an access remedy, which applied to the local loop. Non-discriminatory access to BT’s local loop (Openreach) business was supplied to third parties on the same terms as it was supplied to downstream parts of BT. The obligation applied to the BT Group of companies and its internal divisions, and corporate structure was subject to non-discrimination both on supply and use. This improved upon the AT&T divestiture remedy, which was in operation in the United States at the time. Avoiding the risk of technology change also means taking account of an often-overlooked Consent Decree, which was agreed among BT/MCI/Concert and the DOJ in 1994. That decree broke new ground as it imposed a non-discriminatory “use” obligation on the recipient of services supplied by the monopoly supplier. A similar obligation on non-discriminatory use of inputs could apply to the use by Google of inputs and would apply overtime irrespective of the technical means of supply.

Scale of Google’s data inputs and sunk investments costs

Google now has unrivalled scale in data acquired from billions of users millions of times per day when they interact with Google’s many products. That data is obtained from its ownership of Chrome, the dominant web browser, providing Google with unrivalled browser history data. It also uses other interoperable code (such as that stored in cookies) to check which websites browsers have visited and has an unparalleled understanding of consumers interests and purchasing behavior. Per Judge Mehta’s Memorandum Opinion in USA v Google (Search), data from billions of search histories provides it with “uniquely strong signals” of intent to purchase data that is combined with all data from all other interactions with all of Google’s many products (see trial exhibit of Google presentation: Google is magical). Its knowledge from all data inputs is combined to provide it with high quality information for advertising. The Memorandum Opinion recognizes that “more users mean more advertisers and more advertisers mean more revenues,” and “more users on a GSE means more queries, which in turn means more ad auctions and more ad revenue.” These positive feedback loops suggest increasing returns to scale and returns to the scope of a range of products offered over the same platform using artificial intelligence as part of its systems. It has built one of the most recognized and valuable brands in the world.

The costs facing any competitor seeking to make an entirely new search engine from scratch are now enormous. This is referenced in evidence as the “Herculean problem.” Reference is made to the many billions of dollars that would be needed by Apple to build a new search engine of its own.

Any restoration of competition will now have to overcome these very considerable advantages and sunk costs, while at the same time competing with Google as the established, and well-knownsupplier of the best search engine in the world. That point about the costs being “sunk” for Google but not new entrants will be returned to below.

The Memorandum Opinion refers to the uniqueness of Google’s Search and the search access choke points many times. Access to these unique facilities must now be on the cards as a remedy.

Third party access to data inputs, match keys and access points to support effective competition in “free at the point of use search results businesses”

Google uses data inputs to identify the user’s “purchasing intent” that inform its ads machine. Data inputs are combined from multiple consumer interactions with others digital content and has enabled Google to charge high prices for its search text ads. Google’s Search engine consists of at least three key components: (1) an index of media owner content cataloged by a web crawler, (2) a “relevance engine” to match consumer input to this catalog, (3) ranking and monetization of the search engine results. At a technical level, the online display advertising system relies on match keys that enable the matching of demand for ad inventory to match a supplier of ad inventory. Third parties need access to these data inputs currently uniquely available to Google, to derive user’s purchasing intent. Competing rivals could then employ the input data and match keys to match inventory supporting display advertising and competing search page results businesses using Google’s relevance engine.Use of such inputs would help drive down prices for ads in competing search businesses.

Access points for search businesses include the Chrome browser. Here, the idea that the browser could be quarantined, as suggested by Professor Wu, could be picked up. The browser would also need to be monitored so that it provides a neutral gateway to the web. It is a choke point that can be enhanced with additional functionality – a wallet in the browser substitutes for decentralized wallets that could otherwise be deployed by competing websites. As was the case with the 1956 AT&T consent decree, AT&T was prevented from competing in areas that were open to competition – so too Google could be prevented from adding functionality to its gateway that could be provided by others elsewhere on the web. The browser then loses its position as gateway controller and becomes a neutral window on the web.

Google is owned by Alphabet so there is an opportunity to apply an obligation to Alphabet not to discriminate in the supply of its relevance engine as between Google and third parties rather than its Search system as a whole. That would enable competition between pages and page presentations offered by different businesses. It would overcome the enormous costs and “Herculean” task of creating a new search engine from scratch. New players might then be tempted to enter that business and resell Alphabet’s relevance engine results combined with its own ads or ads from third parties, which would increase price pressure on search ads.

Currently, 80 percent of the SERP is composed of advertising of one sort or another. Enabling competition in the provision of search results could avoid the morass of current search pages and encourage both quality and price competition. This could benefit both consumers and advertisers.Alternative search businesses could be expected to innovate in the way that they provide and present ads; higher proportions of the results pages could be composed of relevant results and fewer ads. If competing businesses had access to Alphabet’s relevance engine and data inputs they could use them for their own advertising, introducing price pressure on Google’s search text ads. New entrants could be expected to finance their businesses quickly given that they would be reselling a proven search product.

Availability of distribution deals with Google’s revenue sharing partners

The current agreements with Apple, OEMs and telecoms carriers operate as exclusive agreements. They contain contractual restrictions in the form of default settings and revenue sharing payments,which incentivize the parties to promote Google Search Ads. The scale of the payments operates as a disincentive and prevents the parties from offering products competing with Google in search.

Removal of only the contractual default setting is likely to be insufficient to end the anticompetitive effect of the agreements and would go no way to restoring competition. The sharing of revenue from Google’s Search advertising must end if competition between new search advertising players is to be established.

Ending the current distribution deals on a revenue-sharing basis creates a problem of what is an acceptable replacement deal. If Google products are to compete on their merits no restriction at all should be imposed on distributors from providing competing alternatives. However, Google’s distributors will still need to be paid for distribution and the volumes and scale of payments is so large that current recipients are still likely to only sell Google products, even if the restrictive provisions are removed. They are unlikely to take the risk of backing a competitor search product if some form of competition in search is not restored. If access to Alphabet’s relevance engine is mandated as described above that would also help to restore competition at the distributor level.

A proposed access remedy needs to underpin the restoration of competition

A remedy order applicable to Alphabet could provide access to an independent and quarantined browser (access point) and search relevance engine. That would not restore competition alone. Overcoming the considerable barrier to entry of a new entrant seeking to build its own relevance engine and attracting new users while competing with Google is very hard. It is currently prohibitive,even for Apple.

When considering the issue further, it is important to appreciate that:

• The relevance engine and index are currently both organizationally and technically separate from the ads and ad network organization.

• Search is currently optimized by people working in a search business. There are separate groups of people that work on products and separate organizations for advertising.

• Alphabet’s products (news, maps, images, shopping, etc.) are interweaved between relevant search results when the page is presented to end users. An effective remedy could build on these existing organizational and business boundaries.

If third party competitors could access the relevance engine and its index on non-discriminatory terms, they may be able to create effective competition between new “Search Engine Results” businesses. Those businesses would access the substantial sunk investments already made in optimizing search relevant to users’ needs and overcome the substantial “Google” brand value. As noted above, that investment is sunk for Google but represents a considerable barrier to entry for others. Since much of that value has been obtained illegally, there would be a case for stripping Alphabet of that value. Perhaps a better solution here would be to enable the use of the brand to support entry. New competitors would be known to be using Google’s world-renowned relevance engine. The established reputation for quality would help entry. As this is central to restoring competition compensation for use is then a non-issue.

Moreover, Google currently offers access to its relevance engine to companies (like Duck Duck Go) that would resell them, so cannot easily suggest that the above proposal is unworkable.

How the proposal addresses technology changes over time

The law has been broken through the denial of access to data inputs and choke points, and thusdeprived rivals of scale. No other players have sufficient scale to replicate Google’s position. Access to the same data that is used in Google Ads would be a starting point for competitors to create competing search ads from. The solution is access to the IDs and the data inputs that Alphabet uses to fund its search business. Obligations can be crafted to access data feeds for non-discriminatory use of whatever Google uses.

To be clear, there are two critical data feeds that will be needed for competitors to function: (1) Access to the Google relevance engine. This would enable competitors to offer a highly relevant search product. Results would be from a proven and established, world renowned and high-quality source; and (2) Access to the data inputs and advertising IDs and match key data, which are used in Google search ads to identify purchasing intent that can be matched with available advertising inventory.

As a matter of U.S. law and practicality, a non-discrimination obligation on usage can be contained in an order addressed to Google as the user of a search engine or data source owned by Alphabet. As a usage–based non-discrimination obligation applicable to the user of assets owned by the head company, Alphabet, it is materially different from a requirement to supply. There is less of a risk of it offending the case law that defers to businesses deciding whether and with whom they contract – it is instead a requirement not to discriminate between what is received by Google’s search business and what is received by third parties’ search businesses. If Google’s monetization of search results uses no inputs from its relevance engine or data hoard, then it would have no obligation to supply.Conveniently the Alphabet holding company could also be the addressee of the obligation, as was the case with BT Group and its operating corporate entities such as Openreach.

Note that this approach also better addresses the issue of technology change over time. The more usual divestiture order and access obligation suffers from technology being defined at the time the order is written. Since it must be written as a remedy to a defined problem and so if the harm was bundling of interoperability or lack of access to XYZ APIs, then the order mandates unbundling and a requirement to supply XYZ APIs. If a new API is invented that achieves a same end by different means, or a new technology is introduced, there will not have been any case against the defendant for abuse with relation to that new API or technology and no order can easily force the supply of the new API. By contrast, where the addressee of the order is in the same group as the supplier an order can be crafted in terms of non-discrimination in the use of the monopoly asset owned by the group head company and used by a functionally separate business.

Conclusions

This essay addresses the core problem for effective remedies identified in USA v Google (Search). Any remedy needs to address the scale of Google’s data inputs and sunk investments. This is remedied by providing third party access to data inputs and access points to support effective competition in “free at the point of use search results” but would also create competing ads businesses with pressure on ads prices. The current distribution and revenue-sharing partners need to be prohibited. The proposed access remedy enables the creation of competition between rival search engine results businesses, imposing market discipline on the promotion and presentation of search results. The proposal addresses technology changes over time by drawing on lessons learned from divestiture in telecommunication and from ensuing that non-discrimination in usage of key inputs is the focus of the remedy.

Additionally, allowing Alphabet to continue to own its browser (even if quarantined) and provide access to search access points means that capital funding will continue to be in the interests of the Alphabet group. Divestiture would otherwise place monopoly assets in others’ hands with incentives to raise price and degrade quality for all those seeking to use them. Funding of divested assets that are currently cost centres in a vertically integrated business would otherwise also be a major issue to overcome. Here, the proposed non-discrimination remedy bites in a different way – so that technology change is not a problem with this type of remedy.

The approach described here would need to be coupled with transparency obligations such that third parties have visibility of what data inputs the Google Search Co receives so that they can make comparisons. Agreements between different divisions of Alphabet – whether partially in separate ownership or otherwise – can be entered into between different corporate entities within Alphabet to more effectively enable oversight across both a corporate and technical boundary. If done carefully, addressing technology, financial and commercial terms, and the scope for technology change circumventing the remedy can be managed. In effect, it would aim to make the remedy future proof.

On the fourteenth of August in the year 2024, The Sling’s humble scribe came into possession of a facsimile of a transcript meticulously typed up by a certain Court Reporter—by way of an avowed acquaintance of the loyal manicurist of said reporter—in the heart of that certain city renowned for its association with that certain Saint, the inimitable bird-bather and wolf-tamer called Francis of Assisi. This impeccable chain of custody establishes beyond reproach the provenance of the narrative contained within the transcript, which itself proclaims an association with that certain hearing in a Court of Judicature in turn associated with the manifold possibilities of crafting a remedy equitably suited to those various monopolistic machinations pertaining to certain shops bearing applications on assorted devices in possession of a telephonic nature.

In the following rendition, all needless matters have been excised, and all excerpts chosen are unerringly and exactly contemporary. So able was the Court Reporter’s work that, in truth, very little was left to the scribe’s editorial discretion but mere clippery, with a few modest extra touches. Indeed, the task could have been delegated to an electronic golem but for the regrettable necessity of forestalling that certain kind of liability associated with counseling readers to engage in nonstandard culinary practices.

Google’s closing argument went… a little something… like this…

Google’s lead attorney, Glenn Pomerantz (henceforth “Google”): Judges shouldn’t be central planners!

Judge James Donato: I totally agree.

Google: Judges shouldn’t micromanage markets!

Judge: I totally agree.

Google: If you order Google to list other app stores on Play, with some interoperability features, you’re a scary unAmerican Soviet central planner.

Judge: Nope.

Google: Yes, you are!

Judge: Not a Communist. Not even a little bit.

Google: Yes, you are!

Judge: Am decidedly not.

Google: Are decidedly too!

Judge: Anything else you’d like to add?

Google: This order would make you a micromanager of markets.

Judge: I’m not telling anyone which APIs to use. There will be a technical monitor.

Google: Then the technical monitor is an unAmerican micromanager!

Judge: Is not.

Google: Is too!

Judge: Let’s move on.

Google: Yes, my next slide says we must march through the case law. The case law says… drumroll! …that central planning is bad.

Judge: I totally agree! That’s why I’m not doing it.

Google: Yes, you are.

Judge: No, I’m not. My order will be three pages long. Focused on general principles.

Google: But you’ll have to rule on disputes the technical monitor can’t resolve—super detailed technical things, possibly beyond human understanding.

Judge: Still not a Communist.

Google: Well, let’s not forget the *life-changing magic* of Google’s *amazing* origin story. Google was pretty much the maverick heroic Prometheus of the Information Superway.

Judge: I totally agree!

Google: You do?

Judge: Yes. Google had superior innovation. Success is not illegal. What’s illegal is then building a moat through anticompetitive practices.

Google: You want to impose these mean remedies because you hate Google.

Judge: Not at all. And this isn’t about me; I’m charged with the duty to impose a remedy based on a jury verdict. I have to follow through on the jury’s conclusion that Google illegally maintained a monopoly over app stores.

Google: That’s central planning!

Judge: Still not a Communist.

Google: I never said you were a Communist.

Judge: Is “central planning” just your verbal tic then? Like um or uh?

Google: Maybe. I’ll have it checked out.

Judge: Nondiscrimination principles and a ban on anticompetitive contract terms are time-tested, all-American, non-Communist remedies.

Google: You know how some people are super-bummed they were born after all the great bands?

Judge: What, are you saying you miss Jimi Hendrix?

Google: That’s more Apple’s thing. What I think about, late at night, is how tragic it is that Joseph McCarthy died so young.

Judge: Huh, Wikipedia says 48. That *is* kind of young.

Google: Thank you for taking judicial notice of that. By the way, have you ever read Jorge Luis Borges?

Judge: Do I look like someone who reads Borges?

Google: Your Honor, Borges had this story about an empire where “the art of cartography was taken to such a peak of perfection” that its experts “drew a map of the empire equal in format to the empire itself, coinciding with it point by point.”

Judge: Do you have a point?

Google: The map was the same size as the empire itself! Isn’t that amazing? We think remedies need to be just like that. Every part of a remedy needs to be mapped onto an exact twin causal anticompetitive conduct.

Judge: That’s not the legal standard for prying open markets to competition. If I don’t grant Epic’s request, what should I do instead?

Google: Instead of Soviet-style success-whipping, the court should erect a statue to my memory. Or at the very least, overrule the jury.

Judge: That’s up to the appeals court now. We’re here to address remedies. You tell me, what’s an appropriate remedy for illegal maintenance of monopoly?

Google: Nothing.

Judge: Not an option.

Google: Okay, look, we’re open to reasonable compromise here: how about a remedy that sounds like something… but is actually nothing?

Judge: What would the point of winning an antitrust case be then? Why would anyone put in all that time and money and effort to bring a case?

Google: Exposure.

Judge: Your competitors aren’t millennial influencers hoping to pay rent with “likes.” They need ways to earn actual legal tender through vigorous competition.

Google: Your Honor, respectfully, legal tender is central planning.

Judge: I guarantee you my order will not touch monetary policy with a ten-foot pole.

Google: Very well but as you can see it is important to start from first principles when debating remedies. Before we do anything rash that could ruin smartphones, crash the entire internet, and send the nuclear triad on a one-way trip to Soviet Communist Russia, we need to take a step back and ask ourselves “What even *is* an app store?”

Donato: Hell no we don’t. We’ve been through *four years* of litigation and a full jury trial. This is no time to smoke up and get metaphysical…

Google: Out, out damn central planner!

Judge: Was that outburst medical or intentional?

Google: Both.

Court Reporter: Can we wrap this up? I’m running late for my manicure.

Judge: I’ve heard enough. I’m mostly going to rule against Google. But there was one part of your argument that I *did* find extremely compelling, and I will rule for Google on that point.

Google: Really?

Judge: Yes, and you put it best on your own website, so I’ll let that record speak for itself: https://tinyurl.com/neu4weu2

Ed. note: Six days later, acting upon advice from a Google search snippet, Soviet troops invaded the courtroom, seeking political asylum.

Laurel Kilgour wears multiple hats as a law and policy wrangler—but, and you probably know where this is going—not nearly as many hats as Reid Hoffman’s split personalities. The views expressed herein do not necessarily represent the views of the author’s employers or clients, past or present. This is not legal advice about any particular legal situation. Void where prohibited.

In late May, the New York Times ran a story by Eric Lipton titled “Elon Musk Dominates Space Launch. Rivals Are Calling Foul.” In response, the antitrust community largely shrugged its shoulders. I went back and give it a read, along with related stories in the Wall Street Journal (“Elon Musk’s SpaceX Now Has a ‘De Facto’ Monopoly on Rocket Launches”), the Washington Post (“SpaceX could finally face competition. It may be too late.”), and CNBC (“SpaceX’s near monopoly on rocket launches is a ‘huge concern,’ Lazard banker warns”). Having reviewed the theories of competitive harm and the publicly available evidence, I conclude that there is a monopolization case worth pursuing here.

Lipton’s piece in the Times contained two noteworthy allegations (emphasis added):

Jim Cantrell worked with Mr. Musk at the founding of SpaceX in 2002. When he started to build his own launch company, Phantom Space, two potential customers told his sales team they could not sign deals because SpaceX inserts provisions in its contracts to discourage customers from using rivals.

Peter Beck, an aerospace engineer from New Zealand, met in 2019 with Mr. Musk to talk about Mr. Beck’s own launch company, called Rocket Lab. Several months later, SpaceX moved to start carrying small payloads at a discounted price that Mr. Beck and other industry executives said was intended to undercut their chances of success.

The first allegation refers to what economists consider an exclusionary contract: You can buy from me only if you commit to not buying from my rival. Other exclusionary provisions include demanding that buyers fulfill a large portion of their needs with the seller or that buyers give the seller a right to match. The second allegation sounds like predation, which requires pricing below a firm’s incremental costs and a likely chance of recoupment. Both are well-recognized restraints of trade that can generate anticompetitive effects under certain conditions, the first of which is when the restraint is employed by a dominant firm.

SpaceX is dominant in space transportation

Firms that are not dominant in a market can engage in exclusionary tactics without fear of exposing themselves to antitrust scrutiny. It is the combination of market power plus an exclusionary restraint that generates anticompetitive effects. Obtaining market shares on a privately held company like SpaceX, is admittedly difficult. But the New York Times story tell us that in 2023, “SpaceX secured $3.1 billion in federal prime contracts, according to the data, nearly as much as the combined amount the federal government committed for space transportation and related services from its nine competitors, from giants like Boeing and Northrop Grumman to startups like Blue Origin.” This statistic implies that, at least as a share of government spending for space transportation, SpaceX commands nearly a 50 percent share. The article also tell us that “SpaceX’s 96 successful orbital launches during 2023 contrast with seven launches to orbit from the U.S. in total last year by all of SpaceX’s competitors,” indicating a share of over 93 percent when measured in terms of launches. In the same story, Musk himself reckons that as of 2023, SpaceX delivered 80 percent of the world’s cargo to space. According to BryceTech, in the fourth quarter of 2023, SpaceX lifted nearly 90 percent of all pounds sent into orbit. Any share in this range (50 to 93 percent) would be consistent with dominance, particularly when combined with evidence of entry barriers.

SpaceX’s market share is protected by entry barriers

By the time SpaceX launched its 63rd mission of 2023, ULA, the next largest U.S. rocket competitor, had completed just two launches. Each rocket launch leads to new data, the same way that each drive by a Tesla owner gave Tesla new information over its electric vehicle rivals. (A similar incumbency advantage owing to learning economies prompted policymakers to endorse subsidizing charging stations and even forcing Tesla to open its stations to EV rivals.) The Washington Post story has a line from the CEO of Firefly Aerospace that supports this effect: “You could see a scenario where one provider has such a lead … that it is literally impossible to catch up on the order where there will be true competition.” Moreover, SpaceX has “deep ties to NASA and the Pentagon, which have awarded it billions of dollars in contracts and elevated it to prime contractor status.”

There are myriad other natural barriers to entry:

- High fixed costs: Lars Hoffman, then senior vice president at Rocket Lab, estimated in 2020 that it cost $100 million to get a rocket to its first launch;

- Long development periods: Development periods of at least three to five years for rockets are common. Blue Origin’s first orbital launch is more than three years behind schedule and now planned for later this year; and

- Strategic launch schedules: According to the Wall Street Journal, “SpaceX’s grip on the launch business means many government agencies and satellite operators must tether their ambitions to the company’s timetables and capabilities.” Per the Washington Post, “SpaceX’s perch atop the industry has allowed it to dictate timelines and prices for satellite launches that favor its launch cadence and schedule, industry officials said.”

In an attempt at journalistic balance, Lipton suggests that competitive entry is picking up despite these natural impediments:

Jeff Bezos’ Blue Origin is close to its first launch for its New Glenn rocket. RocketLab is building what it calls Neutron, and Relativity Space is working on its TerranR, among other new entrants. After years of delays, Boeing is soon expected to start launching NASA astronauts into space on its new Starliner spacecraft.

Lipton ultimately concludes, however, that the ability of the United States to reach orbit in the near term “remains largely dependent on Mr. Musk and his Falcon 9 rocket.” The aforementioned high fixed costs, long development periods, and strategic launch schedules can counter any evidence of initial entry. Even if these natural barriers could be overcome, entrants would still have to hurdle the artificial barriers erected by SpaceX’s two forms of exclusionary conduct.

SpaceX’s ride-sharing program might be predatory

Recall that Mr. Beck of Rocket Lab alleged that SpaceX started carrying small payloads at a discounted price that Rocket Lab could not match. Here’s more on the predation allegation from the New York Times:

[Beck] and other industry executives said they were convinced that SpaceX had set the price for its Transporter service — where small satellite companies can book slots on a Falcon 9 launch — with the explicit goal of undermining the financial plans of emerging competitors. Transporter’s low price — initially $5,000 per kilogram — was below what some industry executives calculated was SpaceX’s basic cost. They concluded that SpaceX could only offer such a low price by subsiding those flights with some of its government contracting revenue.

Beck also asserted that SpaceX was selling flights on its new Bandwagon service, which offers satellite makers launches to orbits that provide them better coverage over key sections of the world, “far below its own costs to undermine its competition.”

To know whether such pricing is in fact predatory, one must estimate the incremental (that is, avoidable) cost for SpaceX’s ride-sharing missions. Adding one payload to a rocket likely imposes no incremental costs for SpaceX. Thus, the test should be performed on a per launch basis.

The best estimate of SpaceX’s marginal costs per launch comes from Musk himself at $15 million under a “best-case” scenario. But that number excludes other avoidable costs, including “the costs to refurbish the first stage rocket booster, and the cost to recover and refurbish fairings.” Musk also claims that, with regard to manufacturing costs, SpaceX incurs “$10 million to manufacture a new upper stage [rocket] and that this stage represents about 20 percent of the cost of developing the rocket.” If SpaceX replaces this upper-stage rocket every mission, then the incremental costs are $25 million.

Turning to the revenue side of the equation, SpaceX’s average incremental revenue per launch has declined to roughly $22.5 million (equal to $300k per payload times the average of 75 payloads per launch). This would not cover the incremental costs estimated above, and to the extent these numbers are accurate, would be predatory. Of course, these estimates are based on publicly available information. An antitrust agency pursuing an investigation would be able to obtain more precise estimates.

I also find the evidence on the likelihood of recoupment to be highly persuasive. The Washington Post story offers this line on ride-sharing: “One example of how SpaceX made it tough on competitors was its move a few years ago to launch smaller satellites in bunches at very low prices in a ‘rideshare program’ that was seen in the industry as a tactic to target smaller launch companies such as Rocket Lab by taking away customers.” The aforementioned evidence of the high fixed costs and long development periods also make recoupment more likely. Finally, the rocket industry is subject to considerable scale economies, so any practice that denies rivals the ability to achieve scale could be seen as exclusionary and consistent with the classic raising-rivals’-cost framework.

SpaceX’s contracts with customers seem to be exclusionary

The second potentially anticompetitive restraint employed by SpaceX is exclusionary provisions in contracts with its customers, comprised largely of government agencies and satellite companies (many of whom compete against Starlink). Here is a little more detail from the New York Times on SpaceX’s contracting:

Mr. Cantrell, whose company Phantom Space has received funding from NASA to help build its new launch vehicle, said his sales team had been told by Sidus Space and a second company that SpaceX had demanded contract provisions intended to limit their ability to hire other launch providers.

Carol Craig, the chief executive of Sidus Space, confirmed in an interview that SpaceX had a “right of first refusal” provision in a deal she had signed for five launches, allowing SpaceX to counter any offers from its competitors.

A right of first refusal, sometimes called a right to match, can foreclose competition to the extent it discourages rivals from making competitive offers to the customer. Why would a rival launch provider bother formulating a costly bid if the incumbent (SpaceX) can end the competition by simply matching the rival’s offer? Economists recognize that such provisions can generate anticompetitive effects when employed by a dominant firm and when the associated “foreclosure share” is economically significant (typically over 30 percent).

The foreclosure share, as the name suggests, is the share of the market that is foreclosed by an exclusionary contract. Consider a market in which a dominant firm supplies 80 percent of the market and half of its customers buy pursuant to a contract that contains the exclusionary provision. In that case, the foreclosure share would be 40 percent (equal to the product of 80 percent market share and 50 percent of customers with the provision). To the extent that most (or all) of SpaceX’s customers have such a provision in their contracts, the foreclosure share should easily clear the 30 percent threshold.

SpaceX could be favoring its own satellite broadband company

Predation and exclusionary contracting fit squarely within antitrust’s orbit (pun intended). Self-preferencing, on the other hand, is harder to police. A classic example is Amazon favoring its own merchandise over that of a rival merchant. SpaceX might be distorting competition in satellite broadband, a vertically related service to rocket launches. That satellite broadband rivals like OneWeb, Kacific, and Echostar rely on SpaceX for launching into space raises natural concerns about preferencing SpaceX’s affiliated satellite broadband company (Starlink). Per the Wall Street Journal story: “’It’s of course a very uncomfortable situation, where you have a supplier that wanted to go down the value chain and start competing with its own customers,’ said Christian Patouraux, chief executive at Kacific, a satellite internet company focused on Asia and the Pacific region. SpaceX launched a satellite for Kacific in 2019.”

Musk insists that SpaceX charges unaffiliated satellite broadband rivals the same as others, but query what SpaceX is charging Starlink (if anything) for launches. Ownership of Starlink also creates a conflict for SpaceX when it comes to scheduling launches for customers: “If Starship doesn’t ramp up as expected, there will likely be a shortage unless SpaceX allocates more of its Falcon fleet for customers instead of Starlink.”

Will the agencies launch a case?

SpaceX’s exclusionary contracts with customers have all the markings of an anticompetitive restraint. While predation cases are rare, SpaceX’s pricing seems oddly low relative to its incremental costs, and the chance of recoupment is high. If an antitrust agency were considering filing a Section 2 complaint against SpaceX, it should push the boundaries by challenging SpaceX’s self-preferencing as well.

Rocket launches are considered a must-have input in the process of transporting satellites, spacecraft, and astronauts in orbit. The launch industry is important to U.S. national security, and the defense agencies should aim to avoid making the government overly dependent on a monopolist, especially a predator. For the foregoing reasons, the antitrust case against SpaceX might soon have liftoff.

My musings on Twitter are mostly a stream of poking fun of corporatist takes in The New York Times or The Economist. Every once in a while, for reasons that are impossible to understand, a tweet takes off, like this one, which mocked a far-fetched inflation theory propagated in a guest essay for the Times on July 8.

Under this theory, elevators and the elevator union are to blame for the housing affordability crisis. The most charitable interpretation, which the title of the piece nearly rules out, is that the high cost of elevators are emblematic of other supply problems exacerbated by onerous regulations. The tweet was retweeted over one thousand times. It seems that the progressive community took umbrage at the Times for breathing life into a YIMBY story that deflected attention away from the powerful companies actually setting rents and towards (largely powerless) elevator workers.

Some of the quote tweets were supportive, and some were not so kind. Matt Yglesias called me a “leftist professor” who “just resorts to bullying” his opponents, and even intimated that I was insensitive to the plight of the disabled community. (Perhaps he was miffed at a prior column.) Of course, the disabled care about access to elevators, but my tweet spoke to the price of housing, and profit-maximizing landlords should not, as a matter of economic theory, factor the fixed cost of elevators into their pricing decisions.

It would be nice for the Times to give some attention to an alternative and more plausible hypothesis behind the housing affordability crisis—namely, that hedge funds and private equity firms have been buying up properties that would otherwise go to households, creating an artificial scarcity in real estate markets, and thereby driving up rents. Matt Darling, who sports a globe emoji in his Twitter handle but is otherwise a decent fellow, questioned whether this alternative hypothesis was serious: “It seems unlikely to be a driving force – there are 146,375,000 houses in the United States. I’d be surprised if private equity buying ‘hundreds of thousands’ is a major contributor.” I promised him I would look into the matter. Here is what I found.

Investors Have Been Busy Gobbling Up Homes

In the first three months of 2024, investors bought 14.8 percent of homes sold according to Realtor.com. In some cities, such as Springfield, Kansas City, and St. Louis Missouri, investors purchased around one in five homes. Investor-owned homes hit their peak in December 2022, accounting for 28.7 percent of all home sales in America. Per MetLife Investment Management, institutional investors may control 40 percent of U.S. single-family rental homes by 2030.

Robert Reich posted a wonderful video to Twitter explaining how Wall Street investors could be driving up rents. He explains that home ownership—the primary vehicle for accumulating wealth—is out of reach for many Americans. Investors are not randomly making home purchases across the country, as Darling’s question above presumes, but instead are targeting bigger cities and neighborhoods that are homes to communities of color in particular. In one neighborhood in Charlotte, North Carolina, Wall Street investors bought half the homes that sold in 2021 and 2022.

Such clustering of properties is occurring in several U.S. cities. A report from Drexel’s Nowak Metro Finance Lab found that between 2020 and 2021, 19.3 percent of sales of single-family homes in Richmond, Virginia, went to investors. It found that investors bought nearly a quarter of the homes in Jacksonville, Florida in the same period.

But Are These Investments Enough to Raise Housing Prices?

Economists have recently begun to explore the relationship between institutional investment and home and rental prices.

- Researchers at the Federal Reserve Bank of St. Louis (2020) found that purchases by institutional investors, as measured by the share of properties owned by all institutional investors collectively in a Metropolitan Statistical Area, increase (1) the price-to-income ratio, especially in the bottom price-tier, the entry point for first-time buyers, and (2) the rent-to-income ratio generally, especially where the housing supply elasticity is high. By treating all institutional investors in the aggregate and thus as if it were owned a single entity, however, the St. Louis Fed study may have overlooked the incremental explanatory power of clustering properties by a single institutional owner in a given neighborhood.

- Watson and Ziv (2021) analyze the relationship between ownership concentration and rents in New York City, finding that a ten percent increase in concentration is correlated with a one percent increase in rents.

- Using a database comprised of all multifamily real estate transactions of greater than $2 million, Tapp and Peiser (2022) estimated the distribution of Herfindahl-Hirschman Indices across all Opportunity Zones within the United States, showing that investors have grown to consolidate a growing share of the affordable rental housing market.

- Linger, Singer and Tatos (2022) used a property tax data from the Florida Department of Revenue to calculate the individual market shares for owners of rental properties based on the number of units owned. For each Census Tract in the state, they calculate the consolidation of properties from 2015 through 2022, and then test whether such consolidation explains increases in rental prices or increases in rental inflation or both, controlling for other factors that might confound the concentration-inflation relationship. They find statistically and economically significant effects in both relationships.

- Using mergers of private-equity backed firms to isolate quasi-exogenous variation in concentration of ownership at the neighborhood level, Austin (2022) found that shocks to institutional ownership cause higher prices and rents.

- Coven (2023) estimated a demand system to study the effects of institutional investors’ conversion of large fractions of owner-occupied housing into rentals in the suburbs of U.S. cities. He finds that institutional investors decreased the housing available for owner-occupancy by 30 percent of the homes they converted, and their demand shock raised the price of housing purchased. He also found such behavior made it easier for renters to access neighborhoods that previously had few rentals.

A seminal lesson in industrial organization is that price coordination is easier, all things equal, when markets are concentrated. Indeed, merger enforcement is partially motivated by the prospect of coordinated pricing effects that flow a merger. So it shouldn’t surprise to anyone that, as institutional investors buy up the available stock of housing in a local market, housing prices rise.

An interesting development that might diminish the impact of clustering properties in a given neighborhood under a single roof, however, is the widespread adoption of pricing algorithms by third-party information aggregators. In March 2024, the Department of Justice opened a criminal investigation of RealPage, a top developer of property-pricing software. A class of renters as well as attorneys general from Washington, D.C. and Arizona brought lawsuits against the beleaguered software company. To the extent monopoly pricing can be achieved even by atomistic property owners via outsourcing the pricing decision to a third party, it might not be necessary to consolidate properties to exercise pricing power.

Policy Implications

In several European countries, such as Spain, Portugal and Greece, foreign investors were encouraged to buy property in exchange for a pathway to citizenship. The programs resulted in a flood of investment and speculation, causing rents to rise above what could be afforded by residents. The incentive plans have since been paired back, with countries hoping to re-direct investment into undeveloped pockets outside of the major cities.

The rather obvious economic lesson is that governments have an obligation to their voters, and free-market forces should not be allowed to price local residents out of their own neighborhoods. The same insight could be applied to domestic speculators in the United States.

In December 2023, Senator Merkley (D-Oregon) introduced the End Hedge Fund Control of American Homes Act, which would force large corporate owners to divest from their current holdings of single-family homes over ten years. Entities that fail to divest homes they own in excess of a 50-home cap would be taxed $50,000 for each excess home. And hedge funds would pay that fine if they own any homes at all after ten years.

Limiting the home ownership of hedge funds and other institutional investors makes economic sense, particularly in concentrated local real estate markets. Government funding of new housing projects also could address the imbalance between private supply and demand. Although it is generally unpopular among neoliberal economists and could weaken incentives to make further investments, capping rental inflation at five percent per year, as intimated by President Biden in this week’s NATO press conference, could also spell relief for renters. And pursuing common pricing algorithms under the antitrust laws could restore renters to the place they would have been absent the alleged price-fixing conspiracy, albeit with a significant lag, given the slow pace of antitrust.

All of these ideas are superior to focusing our energies on elevators. If only we could get the Times to listen.

The Justice Department’s pending antitrust case against Google, in which the search giant is accused of illegally monopolizing the market for online search and related advertising, revealed the nature and extent of a revenue sharing agreement (“RSA”) between Google and Apple. Pursuant to the RSA, Apple gets 36 percent of advertising revenue from Google searches by Apple users—a figure that reached $20 billion in 2022. The RSA has not been investigated in the EU. This essay briefly recaps the EU law on remedies and explains why choice screens, the EU’s preferred approach, are the wrong remedy focused on the wrong problem. Restoring effective competition in search and related advertising requires (1) the dissolution of the RSA, (2) the fostering of suppressed publishers and independent advertisers, and (3) the use of an access remedy for competing search-engine-results providers.

EU Law on Remedies

EU law requires remedies to “bring infringements and their effects to an end.” In Commercial Solvents, the Commission power was held to “include an order to do certain acts or provide certain advantages which have been wrongfully withheld.”

The Commission team that dealt with the Microsoft case noted that a risk with righting a prohibition of the infringement was that “[i]n many cases, especially in network industries, the infringer could continue to reap the benefits of a past violation to the detriment of consumers. This is what remedies are intended to avoid.” An effective remedy puts the competitive position back as it was before the harm occurred, which requires three elements. First, the abusive conduct must be prohibited. Second, the harmful consequences must be eliminated. For example, in Lithuanian Railways, the railway tracks that had been taken away were required to be restored, restoring the pre-conduct competitive position. Third, the remedy must prevent repetition of the same conduct or conduct having an “equivalent effect.” The two main remedies are divestiture and prohibition orders.

The RSA Is Both a Horizontal and a Vertical Arrangement

In the 2017 Google Search (Shopping) case, Google was found to have abused its dominant position in search. In the DOJ’s pending search case, Google is also accused of monopolizing the market for search. In addition to revealing the contours of the RSA, the case revealed a broader coordination between Google and Apple. For example, discovery revealed there are monthly CEO-to-CEO meetings where the “vision is that we work as if we are one company.” Thus, the RSA serves as much more than a “default” setting—it is effectively an agreement not to compete.

Under the RSA, Apple gets a substantial cut of the revenue from searches by Apple users. Apple is paid to promote Google Search, with the payment funded by income generated from the sale of ads to Apple’s wealthy user base. That user base has higher disposable income than Android users, which makes it highly attractive to those advertising and selling products. Ads to Apple users are thought to generate 50 percent of ad spend but account for only 20 percent of all mobile users.

Compared to Apple’s other revenue sources, the scale of the payments made to Apple under the RSA is significant. It generates $20 billion in almost pure profit for Apple, which accounts for 15 to 20 percent of Apple’s net income. A payment this large and under this circumstance creates several incentives for Apple to cement Google’s dominance in search:

- Apple is incentivized to promote Google Search. This encompasses a form of product placement through which Apple is paid to promote and display Google’s search bar prominently on its products as the default. As promotion and display is itself a form of abuse, the treatment provides a discriminatory advantage to Google.

- Apple is incentivized to promote Google’s sales of search ads. To increase its own income, Apple has an incentive to ensure that Google Search ads are more successful than rival online ads in attracting advertisers. Because advertisers’ main concern is their return on their advertising spend, Google’s Search ads need to generate a higher return on advertising investment than rival online publishers.

- Apple is incentivized to introduce ad blockers. This is one of a series of interlocking steps in a staircase of abuses that block any player (other than Google) from using data derived from Apple users. Blocking the use of Apple user data by others increases the value of Google’s Search ads and Apple’s income from Apple’s high-end customers.

- Apple is incentivized to block third-party cookies and the advertising ID. This change was made in its Intelligent Tracking Prevention browser update in 2017 and in its App Tracking Transparency pop-up prompt update in 2020. Each step further limits the data available to competitors and drives ad revenue to Google search ads.

- Apple has a disincentive to build a competing search engine or allow other browsers on its devices to link to competing search engines or the Open Web. This is because the Open Web acts as a channel for advertising in competition with Google.

- Apple has a disincentive to invest in its browser engine (WebKit). This would allow users of the Open Web to see the latest videos and interesting formats for ads on websites. Apple sets the baseline for the web and underinvests in Safari to that end, preventing rival browsers such as Mozilla from installing its full Firefox Browser on Apple devices.

The RSA also gives Google an incentive to support Apple’s dominance in top end or “performance smartphones,” and to limit Android smartphone features, functions and prices in competition with Apple. In its Android Decision, the EU Commission found significant price differences between Google Android and iOS devices, while Google Search is the single largest source of traffic from iPhone users for over a decade.

Indeed, the Department of Justice pleadings in USA v. Apple show how Apple has sought to monopolize the market for performance smartphones via legal restrictions on app stores and by limiting technical interoperability between Apple’s system and others. The complaint lists Apple’s restrictions on messaging apps, smartwatches, and payments systems. However, it overlooks the restrictions on app stores from using Apple users’ data and how it sets the baseline for interoperating with the Open Web.

It is often thought that Apple is a devices business. On the contrary, the size of its RSA with Google means Apple’s business, in part, depends on income from advertising by Google using Apple’s user data. In reality, Apple is a data-harvesting business, and it has delegated the execution to Google’s ads system. Meanwhile, its own ads business is projected to rise to $13.7 billion by 2027. As such, the RSA deserves very close scrutiny in USA v. Apple, as it is an agreement between two companies operating in the same industry.

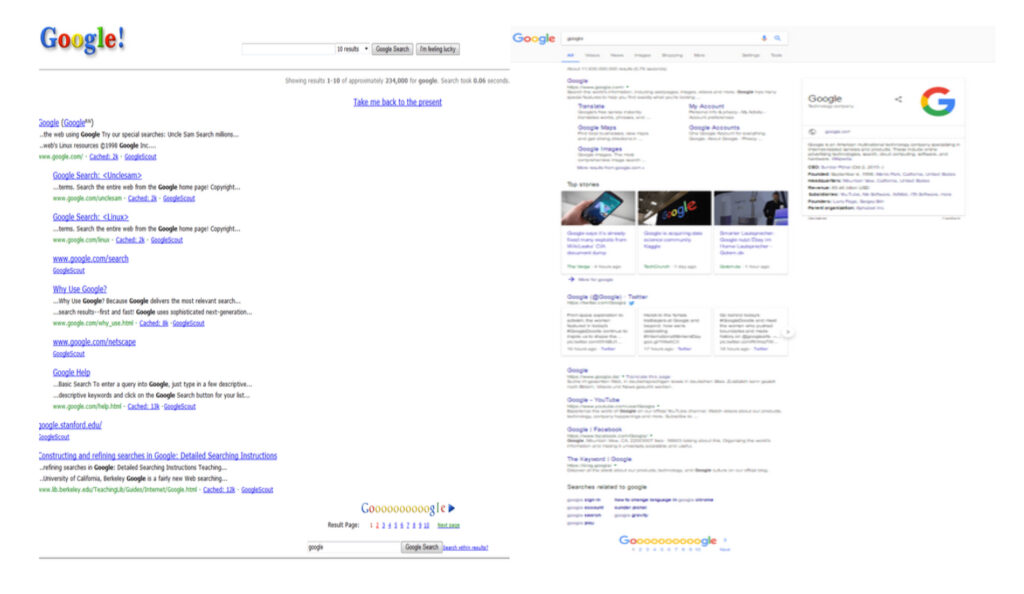

The Failures of Choice Screens

The EU Google (Search) abuse consisted in Google’s “positioning and display” of its own products over those of rivals on the results pages. Google’s underlying system is one that is optimized for promoting results by relevance to user query using a system based on Page Rank. It follows that promoting owned products over more relevant rivals requires work and effort. The Google Search Decision describes this abuse as being carried out by applying a relevance algorithm to determine ranking on the search engine results pages (“SERPs”). However, the algorithm did not apply to Google’s own products. As the figure below shows, Google’s SERP has over time filled up with own products and ads.

To remedy the abuse, the Decision compelled Google to adopt a “Choice Screen.” Yet this isn’t an obvious remedy to the impact on competitors that have been suppressed, out of sight and mind, for many years. The choice screen has a history in EU Commission decisions.

In 2009, the EU Commission identified the abuse Microsoft’s tying of its web browser to its Windows software. Other browsers were not shown to end users as alternatives. The basic lack of visibility of alternatives was the problem facing the end user and a choice screen was superficially attractive as a remedy, but it was not tested for efficacy. As Megan Grey observed in Tech Policy Press, “First, the Microsoft choice screen probably was irrelevant, given that no one noticed it was defunct for 14 months due to a software bug (Feb. 2011 through July 2012).” The Microsoft case is thus a very questionable precedent.

In its Google Android case, the European Commission found Google acted anticompetitively by tying Google Search and Google Chrome to other services and devices and required a choice screen presenting different options for browsers. It too has been shown to be ineffective. A CMA Report (2020) also identified failures in design choices and recognized that display and brand recognition are key factors to test for choice screen effectiveness.

Giving consumers a choice ought to be one of the most effective ways to remedy a reduction of choice. But a choice screen doesn’t provide choice of presentation and display of products in SERPs. Presentations are dependent on user interactions with pages. And Google’s knowledge of your search history, as well as your interactions with its products and pages, means it presents its pages in an attractive format. Google eventually changed the Choice Screen to reflect users top five choices by Member State. However, none of these factors related to the suppression of brands or competition, nor did it rectify the presentation and display’s effects on loss of variety and diversity in supply. Meanwhile, Google’s brand was enhanced from billions of user’s interactions with its products.

Moreover, choice screens have not prevented rival publishers, providers and content creators from being excluded from users’ view by a combination of Apple’s and Google’s actions. This has gone on for decades. Alternative channels for advertising by rival publishers are being squeezed out.

A Better Way Forward

As explained above, Apple helps Google target Apple users with ads and products in return for 36 percent of the ad revenue generated. Prohibiting that RSA would remove the parties’ incentives to reinforce each other’s market positions. Absent its share of Google search ads revenue, Apple may find reasons to build its own search engine or enhance its browser by investing in it in a way that would enable people to shop using the Open Web’s ad funded rivals. Apple may even advertise in competition with Google.

Next, courts should impose (and monitor) a mandatory access regime. Applied here, Google could be required to operate within its monopoly lane and run its relevance engine under public interest duties in “quarantine” on non-discriminatory terms. This proposal has been advanced by former White House advisor Tim Wu:

I guess the phrase I might use is quarantine, is you want to quarantine businesses, I guess, from others. And it’s less of a traditional antitrust kind of remedy, although it, obviously, in the ‘56 consent decree, which was out of an antitrust suit against AT&T, it can be a remedy. And the basic idea of it is, it’s explicitly distributional in its ideas. It wants more players in the ecosystem, in the economy. It’s almost like an ecosystem promoting a device, which is you say, okay, you know, you are the unquestioned master of this particular area of commerce. Maybe we’re talking about Amazon and it’s online shopping and other forms of e-commerce, or Google and search.

If the remedy to search abuse were to provide access to the underlying relevance engine, rivals could present and display products in any order they liked. New SERP businesses could then show relevant results at the top of pages and help consumers find useful information.

Businesses, such as Apple, could get access to Google’s relevance engine and simply provide the most relevant results, unpolluted by Google products. They could alternatively promote their own products and advertise other people’s products differently. End-users would be able to make informed choices based on different SERPs.

In many cases, the restoration of competition in advertising requires increased familiarity with the suppressed brand. Where competing publishers’ brands have been excluded, they must be promoted. Their lack of visibility can be rectified by boosting those harmed into rankings for equivalent periods of time to the duration of their suppression. This is like the remedies used for other forms of publication tort. In successful defamation claims, the offending publisher must publish the full judgment with the same presentation as the offending article and displayed as prominently as the offending article. But the harm here is not to individuals; instead, the harm redounds to alternative publishers and online advertising systems carrying competing ads.

In sum, the proper remedy is one that rectifies the brand damage from suppression and lack of visibility. Remedies need to address this issue and enable publishers to compete with Google as advertising outlets. Identifying a remedy that rectifies the suppression of relevance leads to the conclusion that competition between search-results-page businesses is needed. Competition can only be remedied if access is provided to the Google relevance engine. This is the only way to allow sufficient competitive pressure to reduce ad prices and provide consumer benefits going forward.

The authors are Chair Antitrust practice, Associate, and Paralegal, respectively, of Preiskel & Co LLP. They represent the Movement for an Open Web versus Google and Apple in EU/US and UK cases currently being brought by their respective authorities. They also represent Connexity in its claim against Google for damages and abuse of dominance in Search (Shopping).

Neoliberal columnist Matt Yglesias recently weighed into antitrust policy in Bloomberg, claiming falsely that the “hipsters” in charge of Biden’s antitrust agencies were abandoning consumers and the war on high prices. Yglesias thinks this deviation from consumer welfare makes for bad policy during our inflationary moment. I have a thread that explains all the things he got wrong. The purpose of this post, however, is to clarify how antitrust enforcement has changed under the current regime, and what it means to abandon antitrust’s consumer welfare standard as opposed to abandoning consumers.

Ever since the courts embraced Robert Bork’s demonstrably false revisionist history of antitrust’s goals, consumer welfare became antitrust’s lodestar, which meant that consumers sat atop antitrust’s hierarchy. Cases were pursued by agencies if and only if exclusionary conduct could be directly connected to higher prices or reduced output. This limitation severely neutered antitrust enforcement by design—with a two minor exceptions described below, there was not a single (standalone) monopolization case brought by the DOJ after U.S. v. Microsoft for over two decades—presumably because most harm in the modern (digital) age did not manifest in the form of higher prices for consumers. Under the Biden administration, the agencies are pursuing monopoly cases against Amazon, Apple, and Google, among others.

(For the antitrust nerds, the DOJ’s 2011 case against United Regional Health Care System included a Section 2 claim, but it was basically included to bolster a Section 1 claim. It can hardly be counted as a Section 2 case. And the DOJ’s 2015 case to block United’s alleged monopolization of takeoff and landing slots at Newark included a Section 2 claim. But these were just blips. Also the FTC pursued a Section 2 case prior to the Biden administration against Qualcomm in 2017.)

Even worse, if there was ever a perceived conflict between the welfare of consumers and the welfare of workers or merchants (or input providers generally), antitrust enforcers lost in court. The NCAA cases made clear that injury to college players derived from extracting wealth disproportionately created by predominantly Black athletes would be tolerated so long as viewers with a taste for amateurism were better off. And American Express stood for the principle that harms to merchants from anti-steering rules would be tolerated so long as generally wealthy Amex cardholders enjoyed more luxurious perks. (Patrons of Amex’s Centurian lounge can get free massages and Michelle Bernstein cuisine in the Miami Airport!) The consumer welfare standard was effectively a pro-monopoly policy, in the sense that it tolerated massive concentrations of economic power throughout the economy and firms deploying a surfeit of unfair and predatory tactics to extend and entrench their power.

Labor Theories of Harm in Merger Enforcement

In the consumer welfare era, which is now hopefully in our rear-view mirror, labor harms were not even on the agencies’ radars, particularly when it came to merger review. By freeing the agencies of having to construct price-based theories of harm to consumers, the so-called hipsters have unleashed a new wave of challenges, reinvigorating merger enforcement, particularly in labor markets. In October 2022, the DOJ stopped a merger of two book publishers on the theory that the combination would harm authors, an input provider in book production process. This was the first time in history that a merger was blocked solely on the basis of a harm to input providers.

And the DOJ’s complaint in the Live Nation/Ticketmaster merger spells out harms to, among other economic agents, musicians and comedians that flow from Live Nation’s alleged tying of its promotion services to access to its large amphitheaters. (Yglesias incorrectly asserted that DOJ’s complaint against Live Nation “is an example of the consumer-welfare approach to antitrust.” Oops.) The ostensible purpose of the tie-in is to extract a supra-competitive take rate from artists.

Not to be outdone, in two recent complaints, the FTC has identified harms to workers as a critical part of their case in opposition to a merger. In its February 2024 complaint, the FTC asserts, among other theories of harm, that for thousands of grocery store workers, Kroger’s proposed acquisition of Albertsons would immediately weaken competition for workers, putting downward pressure on wages. That the two supermarkets sometimes poach each other’s workers suggests that workers themselves could leverage one employer against the other. Yet the complaint focuses on the leverage of the unions when negotiating over collective bargaining agreements. If the two supermarkets were to combine, the complaint asserts, the union would lose leverage in its dealings with the merger parties over wages, benefits, and working conditions. Unions representing grocery workers would also lose leverage over threatened boycotts or strikes.

In its April 2024 complaint to block the combination of Tapestry and Capri, the FTC asserts, among other theories of harm, that the merger threatens to reduce wages and degrade working conditions for hourly workers in the affordable handbag industry. The complaint describes one episode in July 2021 in which Capri responded to a pubic commitment by Tapestry to pay workers at least $15 per hour with a $15 per hour commitment of its own. This labor-based theory of harm exists independently of the FTC’s consumer-based theory of harm.

Labor Theories of Harm Outside of Merger Enforcement

The agencies have also pursued no-poach agreements to protect workers. A no-poach agreement, as the name suggests, prevents one employer from “poaching” (or hiring away) a worker from its competitors. The agreements are not wage-fixing agreements per se, but instead are designed to limit labor mobility, which economists recognize is key to wage growth. In October 2022, a health care staffing company entered into a plea agreement with the DOJ, marking the Antitrust Division’s first successful prosecution of criminal charges in a labor-side antitrust case. The DOJ has tried three criminal no-poach cases to a jury, and in all three the defendants were acquitted. For example, in April 2023, a court ordered the acquittal of all defendants in a no-poach case involving the employment of aerospace engineers. (Disclosure: I am the plaintiffs’ expert in a related case brought by a class of aerospace engineers.) Despite these losses, AAG Jonathan Kanter is still committed as ever to addressing harms to labor with the antitrust laws.

And the FTC has promulgated a rule to bar non-compete agreements. Whereas a no-poach agreement governs the conduct among rival employers, a non-compete is an agreement between an employer and its workers. Like a no-poach, the non-compete is designed to limit labor mobility and thereby suppress wages. Having worked on a non-compete case for a class of MMA fighters against the UFC that dragged on for a decade, I can say with confidence (and experience) that a per se prohibition of non-competes is infinitely more efficient than subjecting these agreements to antitrust’s rule-of-reason standard. Again, this deviation from consumer welfare has proven controversial among neoliberals; even the Washington Post editorial board penned as essay on why high-wage workers earning over $100,000 per year should be exposed to such encumbrances.

Consumers Still Have a Cop on the Beat