It has become quite common to accuse antitrust enforcers of bias and seek their recusal. FTC Chair Lina Khan and DOJ Antitrust Division AAG Jonathan Kanter have been the subject of calls for recusal in cases involving corporate giants such as Meta, Amazon, and Google.

The argument is that these individuals are biased in their enforcement of antitrust law. Ideology, in the case of Chair Khan, was initially honed by writing an article in law school and working for a non-profit. Learned and developed understanding is something that is somehow problematic to some in the pursuit of antitrust enforcement.

In contrast, nominees to run the DOJ and the FTC frequently have experience defending against agency enforcement. They will spend time at the agency, to varying degrees, making minute changes to the state of current enforcement (or lack thereof). Then, they will leave and go back to the defense bar. That does not create calls of bias. In fact, that time “in the trenches” is celebrated as valuable experience.

Whether defending an action or enforcing an action before returning to the defense bar, the reason that no one objects to that “bias” in those realms is that they share the same faith. Thus, it doesn’t matter if you once represented corporations—the common belief is that antitrust enforcement agencies should not delve too deeply into monopolization, there should be blessing of efficiencies in mergers, and that the risk of improper enforcement is greater than the risk of non-enforcement. All believers of the same principles cannot be biased, after all.

The faith is called “Consumer Welfare.”

But these new enforcement officials aren’t practitioners of that faith. And that is perhaps the primary reason that there is much ire about the draft Merger Guidelines and one if its (many) drafters, FTC Chair Lina Khan. The drafters of those guidelines are seeking to disrupt the Consumer Welfare faith, replacing it with the science of modern economics and a return to the statutory goals.

Yet disciples of the faith do not like change. And their belief system has been beneficial to everyone who spins through the revolving door, often times at rapid velocity. But that same system harms consumers, workers, independent business people, citizens, and anyone else lacking voice and who are not members of this particular faith.

In what follows, I detail why Consumer Welfare Theory is a faith, not science. I then explore how there are multiple sects within that faith and how they interplay with one another, all the while perpetuating the faith. I then detail ways in which the faith protects itself from challenge, both scientific and policy based. Finally, I propose a solution.

The Faith of Consumer Welfare

Consumer Welfare Is Internally and Irretrievably Flawed

A faith, according to one definition in Merriam-Webster dictionary, is a “firm belief in something for which there is no proof.” Faith is closely held, and not readily dismissed even in the face of evidence to the contrary. Faith is powerful and should not be discounted.

But faith is not science. There is no ability to verify empirically someone’s faith. Nor is it necessarily logical. Logic suggests that should some assumption prove false; the claim is rejected. Faith exists even when there is evidence to the contrary.

Consumer Welfare, which is the faith adhered to by agency heads past, is not logical because it is based on disproven theory. Modern economics—the social science of economics and not the Consumer Welfare faith of antitrust practitioners—has disproven consumer welfare theory and surplus approaches to welfare. My coauthors and I have detailed this literature here, here, here, and here. In some instances, we have made new claims of intractable problems, and have been met with silence.

Consumer Welfare and its assumptions have also been empirically disproven in many aspects.

For example, mergers do not create efficiencies by and large, except perhaps by happenstance. But notions of efficiency that flow through merger have been disproven. Much of Consumer Welfare has even been disproven by its own followers, the Post-Chicago School. Yet its disciples cling on. There is also strong evidence of increasing concentration in industries across the United States, lower productivity, greater disparities of income. As a policy for the goals of antitrust, evidence suggests Consumer Welfare theory empirically performs poorly.

Despite these criticisms that condemn the theory, and even though modern economics as a science has moved on from it, Consumer Welfare Theory is embraced today in antitrust law. One might hope for a Kuhnian scientific revolution, but rejection of empiricism and logic is a faith-based decision. Indeed, it is fanatical devotion.

“Follow the Gourd! Follow the Shoe.”

In Monty Python’s The Life of Brian, Brian, a false prophet, drops his shoe and his gourd (literal, not metaphorical gourd). His followers splinter into camps of shoe followers and gourd followers. But Brian remains the leader of both sects.

Similarly, the Chicago School and the Post-Chicago School still cling to the same prophet of Consumer Welfare. The Post-Chicago School debunked many of the claims of the Chicago School, but still clung to the religion. To mark their distinction, the Post-Chicago School argued for a kinder, gentler form of Consumer Welfare: A new testament, if you will. Consumer Welfare as embodied in modern antitrust law was the faith created by High Priest Robert Bork and his followers who sought to curb antitrust enforcement. Yet the faith has expanded, in large part due to defenses of the Consumer Welfare standard stemming from people claiming that they are pro-enforcement.

But it’s hard to know what the various sects of this faith are. As Professor Scott-Morton and Leah Samuel point out, there is no clear definition among the devout about what consumer welfare means:

This divergence in terminology means that participants in a debate about CWS are often talking about fundamentally different things. At some point, despite the best efforts of many economists at many antitrust conferences, this barrier to effective communication has become insurmountable. For reasons that are entirely understandable, Neo-Brandeisians have won the terminology debate in policy discourse and the media. Clear communication isn’t possible among Neo-Brandesians, Borkians, and academic economists when they use different definitions of the same term. Making things worse, any quotation from jurisprudence or analysis of past decades reflects the definition of its time.

The lack of an objective reference is further evidence of the faith-based quality of Consumer Welfare among antitrust practitioners and scholars. However, followers of this approach often blend together and come back to the original faith.

Consider the “output” sect led by Professors Herb Hovenkamp and Fiona Scott-Morton, who appear to believe the goal of antitrust is to maximize output. In this discussion, there is an explicit recognition that output does not increase welfare without strict assumptions. Yet this sect exhibits a faith-based defense of using output to measure welfare and defending consumer surplus: “When those tools [regulation, consumer protection, and product labeling] do a good job, output returns to its role as a good proxy for consumer welfare.”

The authors add: “When an economist examines a practice and concludes that it increases ‘welfare,’ the evidence supporting that claim is commonly that the practice increased output or reduced price.” But that simply isn’t true anymore.

Thus, it appears that the output sect is linking output to consumer welfare (with some herculean assumptions). But not necessarily: Professor Hovenkamp has said that you “don’t even need a welfare metric.” So, output as a sect of welfare assumes output on its own is good. But then again, apparently not always.

Post-Chicago economics added the Trading Partners sect. This sect claims a pro-enforcement stance, but cling to a version of surplus measurement known as “trading partners.” As they point out, as several post-Chicago lawyers and economists stated in their comments regarding the draft Merger Guidelines:

We understand merger analysis to be concerned with the risk that a merger will enhance the exercise of market power, thereby harming trading partners (i.e., buyers, including consumers, and suppliers, including workers). Market structure matters in merger policy when it is an indicator of the risk that firms will have the ability and incentive to lessen competition by exercising market power post-merger (or an enhanced ability and incentive to do so), to the detriment of trading partners (buyers or sellers) in the relevant market.

Professor Hovenkamp, an apparent advocate of this sect as well, states:

What we really want is a name for some class of actors who is injured by either the higher buying price or the lower selling price that attends a monopolistic output reduction. In the case of a traditional consumer the primary cause of this injury is reduced output and higher prices. In the case of a supplier, including a supplier of labor, the primary cause is reduced output and lower selling prices. In both cases there are also injuries to those who are forced out of the market.

As my coauthors and I have stated elsewhere, “This is really a wrinkle on the original Consumer Welfare Standard because it simply adds the input market surplus to the consumer surplus.” It does not account, however, for all the other things that modern economics would include for consideration and the original intent of Congress. However, “to their credit, the Post-Chicago School has demonstrated that even when the antitrust inquiry is limited to prices and costs (that is, total surplus), the Chicago School’s program of weak merger enforcement is not justified.” A New Testament for Consumer Welfare, if you will, without the hellfire and damnation cast toward enforcement like the original.

But that original school of Consumer Welfare still exists. Namely, the original notion that most, if not all intrusions by the government into the market will do more harm than good. While there might be exception for realms of naked price fixing, the remainder of antitrust enforcement should be restrained to a great degree. Let’s call this group the Inner Chamber.

Members of the trading partners sect, the output sect, and the Inner Chamber may be talking past each other in ways that science would not be able to grasp. However, stepping outside the “trenches,” one finds a very common meaning of consumer welfare and a very common understanding of welfare in the science of economics.

Let’s Not Call It Death Grip Consumer Welfare Anymore

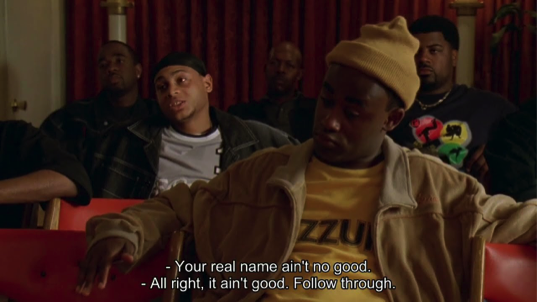

In The Wire, Stringer Bell is tasked with the sale of an inferior product. It simply doesn’t work. To attract new customers, Stringer, after consulting his economics professor, decides to rebrand. He has some things to teach his followers:

Stringer: “Alright. Let’s try this. Y’all get jacked by some narcos. But y’all clean. Y’all got an outstanding warrant, like everybody in here, and what do you do?”

Poot: “Give another name.”

Stringer: “Why?”

Bodie: “Because your real name ain’t no good,”

Stringer: “All right — it ain’t good, and? Follow through.”

[silence]

Stringer: “ Alright. ‘Death Grip’ ain’t shit.”

Poot: “We change up the name.”

Stringer: “What else?”

Shamrock: “Yo I got it. Change the caps from red to blue. Make it look like we got some fresh shit.”

To maintain popularity, oftentimes faiths “rebrand.” The goal of rebranding, perhaps, is to regain appeal as time passes.

Rebranding has been advocated in the faith of Consumer Welfare. Consider Leah Samuel and Professor Scott-Morton’s take:

Economists face a huge problem with the label they use for the textbook consumer welfare concept if they want to be understood by a larger society that uses the now-common restrictive definition. To foster understanding, economists should be happy to rebrand what they used to call “consumer welfare.” In his presentation to the FTC in 2018, Carl Shapiro suggested a “Protecting Competition” standard (cheekily subtitled “The Consumer Welfare Standard Done Right With Better Name”). It would have almost the same textbook economic meaning as consumer welfare, but the legal meaning would be explicitly framed as broader than the “consumer welfare standard” that is so railed against in the press and employed by courts.

Rebranding seems like an odd thing for a science to do. If the polestar of antitrust were gravity instead of Consumer Welfare, would we tell academics to stay out of the antitrust lane because in antitrust we mean something different by gravity? Maybe not call it gravity? Apparently.

Physics principles, from which much of neo-classical economics is taken, is still called Physics, although I recognize sub-disciplines emerge. But those sub-disciplines cling to the same principles of science. One simply does not rebrand “gravity,” despite it being the source of many failures of grace.

On the other hand, if no one knows to what they are referencing before the rebrand, there is a risk of Charlatanism. It is already the case that some of the sect leaders move freely between the sects, and there is great potential that even a well-meaning, pro-enforcement sect will be coopted by the dominant anti-enforcement sect within the faith. No, that is not what we mean. You are wrong as to what we mean. As we’ve seen in the Google trial already and in the Microsoft trial, given this confusion, even one’s deeply held core beliefs might change depending on time and place. Take, for example, the cross-examinations of Hal Varian and Richard Schmalensee with their own teachings. Even Robert Bork’s faith has been questioned.

Keeping the Faith

Practitioners of a faith can be harsh to those outside their belief system

Unlike the truly devout, New Brandeisians hate low prices and more output, the story goes:

… Neo-Brandeisians generally do not reject the conclusion that larger firms can benefit from economies of scale and scope. Indeed, Neo-Brandeisians often point to expected economies of scale as a cause for concern regarding mergers and acquisitions because combined entities may be able to lower prices and out-compete some other incumbent firms. This demonstrates that the implementation of Neo-Brandeisian policy prescriptions would likely burden consumers with higher prices and reduced output and/or quality in exchange for some mix of Neo-Brandeisian priorities, such as smaller firm sizes and a larger number of total firms.

Because New Brandeisians take into account other considerations, they must be seeking to injure consumers. Low prices and greater output are THE goal, and competing notions will injure that goal. They are thus labeled “activists” who engage “bad faith” arguments and “myths.”

Faiths frequently use parable to defend the defenseless notion. Rather than debate the importance of measures which modern economics (and ancient Congresses) have deemed important, easier to pin the label of “high price heretic” on the New Brandeisians.

This is perhaps why FTC Chair Lina Khan has been the subject of so much hostility in the antitrust world. The Wall Street Journal, the oracle of Consumer Welfare, has devoted enough space to the FTC Chair that no one could question its devotion to the faith. The defense bar is up in arms. And, with the new draft Merger Guidelines, there are even suggestions that the lords of Consumer Welfare—the Courts—would surely cast out such heresy.

It is common to see the New Brandeisians being cast as the zealots. In recent conversations, people have described the New Brandeisians as “activists” and the draft Merger Guidelines as a “manifesto,” perhaps coming from “Marxists.” Heretics aligned with such heresy must be cast out and shunned.

Faiths Appeal to Established Beliefs, Often to Protect Against a Threat

Faith-based anti-intellectual arguments are not new to economics. Consider the reaction to Pierre Sraffa’s “double switching argument,” which proved that the neoclassical theory of distribution was untenable. Sraffa proved, that in “general, there is no logical way by which the “intensity of capital” can be measured independently of the rate of interest — and hence the widely held neoclassical explanation of distribution of income was logically untenable.”

Paul Samuelson sought to defend the neoclassical religion from the logical contradiction Sraffa proved through allegory–an allegory with heroic assumptions. It was an attempt to defend a lapsed logical proof, but one that was still appealing as a religious allegory. As E.K. Hunt points out by citing Bernard Harcourt:

The neoclassical tradition, like the Christian, believes that profound truths can be told by way of parable. The neoclassical parables are intended to enlighten believers and nonbelievers concerning the forces which determine the distribution of income between profit-earners and wage-earners, the pattern of capital accumulation and economic growth over time, and the choice of the techniques of production associated with these developments. . . . [These] truths . . . were thought to be established . . . before the revelations of the false and true prophets in the course of the recent debate on double switching.

The required assumptions for Consumer Welfare to be measured by output are nigh-impossible to be satisfied on earth. The trading partner approach has flaws that are equivalent to the flaws repeatedly detailed about Consumer Welfare theory. In fact, no sect in the Consumer Welfare religion is immune for these damning scientific criticisms. Unlike scientific revolutions, faith continues merrily on, although some have chosen to cast those proving such criticisms (and moving on to more sound policy) as heretics who seek to do harm, lacking in understanding of science.

Indeed, with regard to any faith lacking in evidence, the appeal is to emotion. C.E. Ferguson, in his preface to the book, admits this (in defense of Samuelson’s parable): “Placing reliance upon neoclassical economic theory is a matter of faith. I personally have the faith; but at present the best I can do to convince others is to invoke the weight of Samuelson’s authority.”

Joan Robinson concluded the debate about double switching with a quote that is apt about consumer welfare and its unproven and unproveable theory. In lambasting Ferguson for failing to engage in scientific endeavor:

No doubt Professor Ferguson’s restatement of “capital” theory will be used to train new generations of students to erect elegant seeming arguments in terms which they cannot define and will confirm econometricians in the search for answers to unaskable questions. Criticism can have no effect. As he himself says, it is a matter of faith.

If Consumer Welfare theory is faith, then I must still provide an answer as to why it is so appealing as such. My answer: Because all the players win.

Faith Is Rewarded

The popularity of a faith is in its ability to create comfort. Karl Marx’s famous line about religion was not disparaging: “Religion is the sigh of the oppressed creature, the heart of a heartless world, and the soul of soulless conditions. It is the opium of the people.” Thus, a religion makes you feel good. Or at least one would hope.

The faith of Consumer Welfare does make everyone involved feel good.

Practitioners and consulting economists can feel good because they are representing the parties before the agencies. They are limiting the excesses of government, while being paid well to do so. For government attorneys, a “win” involves a settlement (it does not matter the degree). A consent decree is a win, for budgetary purposes. A successful trial is a win. And, if the parties abandon a transaction, that is a win, too. While government attorneys are not paid well, they can take solace in doing the “people’s work,” or eventually leave to work on the better-paying side.

I am not stating that there are merchants in the temple that should be cast out. Because this faith allows for profiting from it.

The Faithful Gather to Reinforce Their Faith

Faith is based in part on gathering. The temple for Consumer Welfare adherents is the Marriott Marquis in D.C. The service is the ABA Antitrust Section Spring Meeting. During this service, the practitioners of the religion discuss the meanings of ancient texts. Some are rejected because of their age and in light of modern interpretations, such as Brown Shoe. Others are lauded still because they are consistent with modern thought, such as Marine Bancorp. (Justice Powell wrote the famous memo advocating for conservative antitrust and Consumer Welfare theory). High priests, people who have wrestled with these tomes—economists, law professors, and lawyers—debate within small margins the meanings of these sacred texts, often picking and choosing verses that appeal mostly to themselves.

Unlike other religions, debate (within limits) is welcomed, particularly those who play an important role on “both sides” of the debate. But the debate is friendly compared to the nastiness of attacks on the New Brandeisians. Here, people might switch sects in the Consumer Welfare faith and still be welcomed. They might even switch sides “in the trenches” between government and private practice. It’s not a war. No French crossed into German Bunkers in World War I without being called a traitor or deserter.

Friendly discourse in the faith does not yield an unending number of Wall Street journal op-eds attacking you personally, or your FTC Commissioner colleague calling you a Communist. Both sides, within each sect, is still within the Church of Consumer Welfare’s teachings.

This is perhaps why Chair Khan has been the subject of so much hostility in the antitrust world. The Wall Street Journal, the oracle of Consumer Welfare, has devoted enough space to the FTC Chair that it could itself be the foundation of its own faith. The defense bar is up in arms. And, with the new draft Merger Guidelines, there are even suggestions that the lords of Consumer Welfare—the Courts—would surely cast out such heresy from “Marxists.”

Faith Wavers, but Never Fails

Should one point out that the arguments of faith themselves go against the teachings of the faith, things get awkward. I have at various points sardonically argued that antitrust should only be about per se illegal activity such as price fixing and bid rigging. If monopolies cannot undermine the competitive process because they are temporary and most mergers are efficient, why create such huge taxes on corporations by applying the rule of reason? Indeed, detractors of recent proposed amendments to HSR filings have argued such a point.

If enforcement only makes sense for per se violations, and if the deterrent effect were properly understood by would-be cartels, shouldn’t nearly everyone in the ABA defense bar be out of a job? Shouldn’t most antitrust enforcers similarly be fired? Isn’t antitrust enforcement for single-firm monopolization and merger cases “inefficient?” The response to such a comment is usually that antitrust serves a useful purpose of deterring harmful conduct and mergers. But doesn’t it also create great Type I errors? Should we not weigh those? Raise this argument at the Spring Meeting and watch the rallying cry of the defense bar for the antitrust status quo.

But even those practitioners of the Consumer Welfare Religion who earnestly seek broader antitrust enforcement have limits in their faith. Consider an argument I pose frequently to disciples of efficiency (cost savings), a tenet of the Consumer Welfare religion. Consider a merger between two firms (both do business in the United States). Suppose one has beneficial ties to a country where child labor is legal, and the other has capital to build plants there. Suppose the firms prove (and the foreign government also corroborates) that the merger will lower costs, increase output, and use child labor as the basis of the lower costs. Disciples will call into question whether their religion has anything to say on this, despite the efficiency doctrine being right there for the taking. Implicit in the discomfort is a recognition that antitrust has other purposes at hand. The hypothetical tests their faith.

The point of this example is not that supporters of consumer welfare are pro-slavery and pro-child labor. The point of the example is that faith wavers, but not for long.

Adding Science by Killing Faith

When a discipline ceases being a science and becomes a faith, it can no longer accept advancements. Entrenchment becomes the norm. And ultimately, the field dies under its own ignorance, perhaps taking society down with it.

The New Brandeisians have modern economics—the science, not the Consumer Welfare faith—on their side as well as the original goals of Congress in passing the antitrust laws. Antitrust law was hijacked by Consumer Welfare theory, and it is time to put an end to that flawed economic science now undertaken as faith. To question the status quo, as Galileo discovered, no doubt creates hostility.

As New Brandeisians fight the fight, it is almost with glee that members of the Consumer Welfare Faith celebrate the losses. With the remorse is an gleeful tone when some members of the defense bar speaks of the FTC’s losing streak. As Homer Simpson once famously said, “Well son, you tried and you failed. The point is, never try.” In terms of single-firm monopolization cases, the agencies, until very recently, appeared to have taken this advice.

Some Solutions and a Conclusion

I do not have answers that will ever be implemented given the strength of the faith and the forces that propel it. I’m sorry if you thought I would, having taken my statement in the introduction that I had such solutions on faith.

That’s the thing about faith. Sometimes it isn’t warranted.

The views in this essay do not reflect the view of my coauthors, my employer (the Great State of Texas), the Utah Project, my school of Kung Fu, or any other group with which I’m affiliated. I speak solely for myself. I do not have any clients. I am not seeking any appointment to any government agency. Nor do I anticipate them seeking me. I don’t anticipate any of those things changing after I write this.